2060 Impact Fund is an innovative impact investment fund that is part of the impact-driven venture builder, Amisi & Company. We conduct rigorous targeted research in informal markets, tailor unconventional funding structures to local contexts, and deploy capital to address the most important issues. Our impact investing approach delivers better outcomes and empowers the underserved, underinvested, and misunderstood segments in Congo’s large informal economy, a sector that is a crucial source of income and employment for Congolese families.

The 2060 Impact Fund is deeply rooted in our experience growing up in extreme poverty and living in towns with no formal jobs, no upward mobility, and in a country where informal employment made up a significant portion of the national economy. Decades later, here we are. The informal sector is still the country’s main job creator and income generator for millions of households. Indeed, more than 90% of employment in the Democratic Republic of the Congo is informal. Thus, our deep understanding of the complexity of this informal environment, our ingrained data culture, our strategic use of capital as a force for good, and our profound sense of moral obligation to unlock the untapped entrepreneurial potential of Congo’s informal economy puts us in an avant-garde position as we blaze a new path for wealth creation and bring the informal sector into the formal economy.

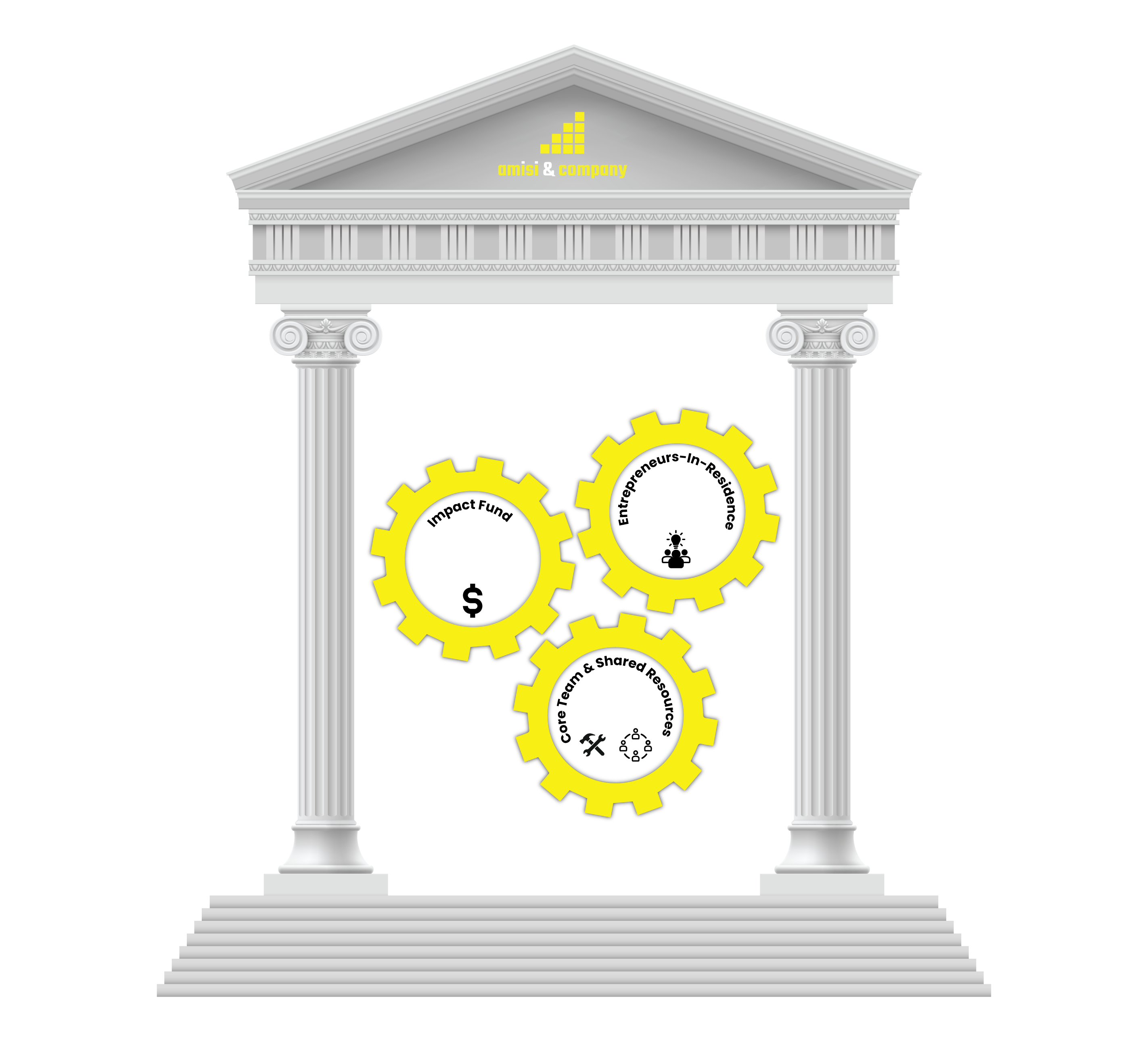

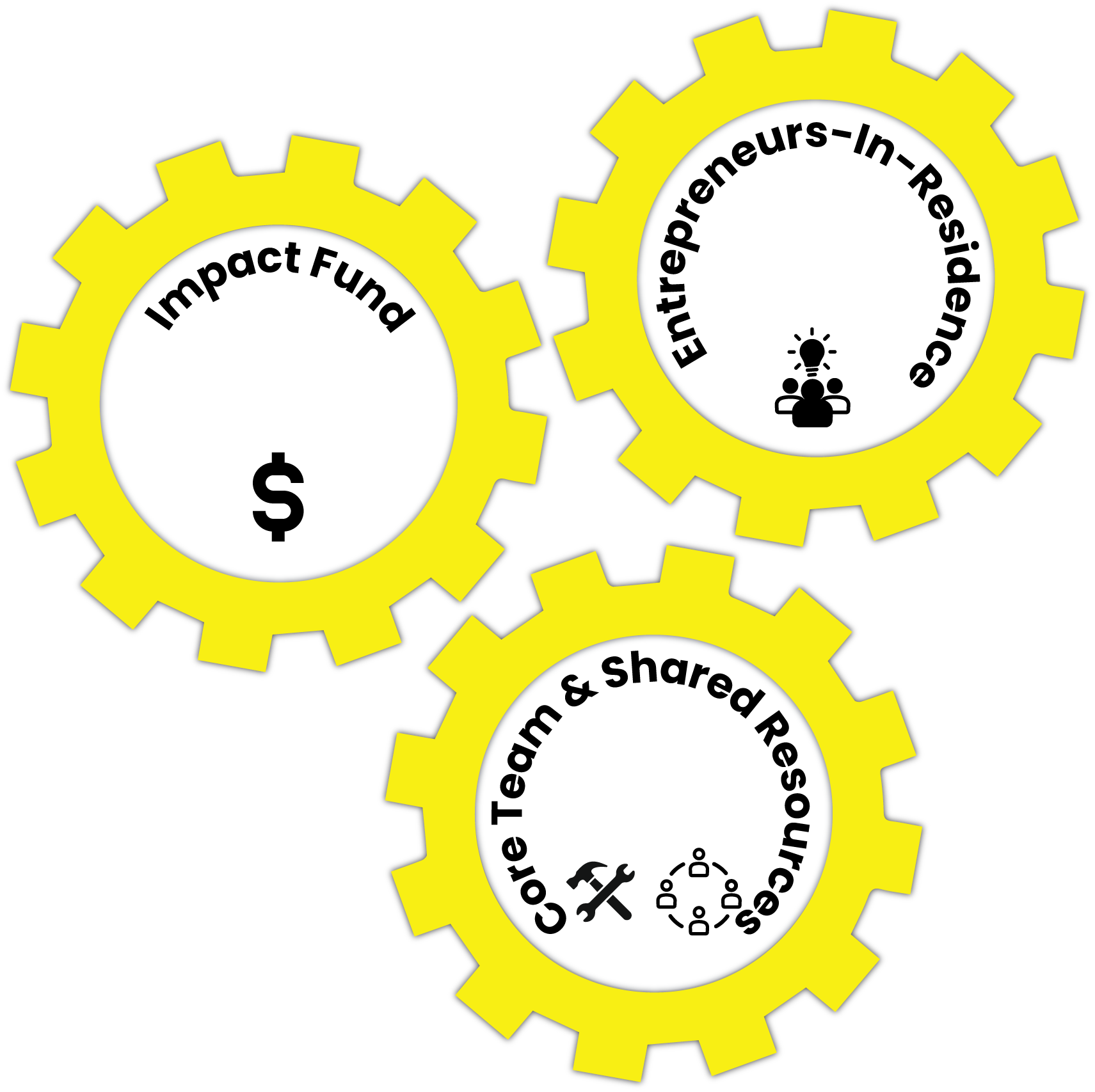

Furthermore, the 2060 Impact Fund is housed in Amisi & Company, a living and learning ecosystem of impact-driven innovators and change-makers who are driven to advance a sustainable economy and create shared prosperity. Leveraging the internal ecosystem of our impact-driven venture builder enables us to make use of the full extent of our capabilities and in-house resources. Here, we intentionally connect capital to social, environmental, and economic solutions which are well-suited to local realities. Thus, we maximize impact and generate competitive financial returns.

“If not us, then who? If not now, then when?”

– John Lewis

We do this work because necessity is the mother of invention. Reason and evidence have taught us that the traditional venture capital model does not perfectly translate to the socio-economic realities found in the overlooked informal economy. There are countless serious real-life problems left to be solved in our communities, and the Silicon Valley venture capital model is not adapted to systemic societal challenges that informal entrepreneurs tackle daily. The classical venture capital structure is not well suited to real needs on the ground. Sadly, a significant number of venture capitalists are western-centric and only see the world through the Silicon Valley lens. How can we make the world a better place and advance economic equity by holding a single-minded view?

It is shocking to see the number of venture capitalists who subscribe to models, frameworks, and ways of thinking that may work elsewhere but make no sense in the African context. They often fail to understand the contextual complexities specific to each African country. Even the impact investment model, which is relatively new, still has a long way to go if we truly want to see better outcomes that maximize positive impact without sacrificing financial return and drive real progress in places with far fewer business resources, no middle class, lower purchasing power, nonexistent entrepreneurial infrastructure and much greater macroeconomic instability, like Congo.

That is why we started the 2060 IMPACT FUND: to write our own playbook to unlock the informal sector’s massive economic potential as a dynamic and resilient engine providing livelihoods for more people than the formal economy. The informal sector is the backbone of the economy. We are intentionally taking a unique path that requires a new way of thinking about investing. Why? Because reality on the ground has taught us tough lessons: context matters, and what is impactful to us is not the same for others.

Coming soon Coming soon Coming soon Coming soon Coming soon Coming soon Coming soon Coming soon Coming soon Coming soon Coming soon Coming soon

© 2025 Amisi & Company, All Rights Reserved.